(Note – This is the first in a 3-part series where I share some of my “secrets” to scaling a performance marketing business.)

My friend Joshua Lee just published a book titled “Balance is Bullshi*t”. It’s about people, work, and all that fun stuff. But it could very well be about marketing and building a business.

In our normal lives, many of us think we want “balance” and believe that balance means having a lot of a bunch of things. The problem is that it’s very easy to hold that perspective but not go hard in any one thing.

In business, just as in life, it can be easy to be lured (read: distracted) by the shiny bright object of the day. (I’m talking to you @GaryVee and your obsession with telling people to allocate 5-10% of their time to Snapchat when for most of your audience, that’s a valuable percent of their time. Not to mention, that doing so, pulls important mindshare away from their core business. Plus, is it ever really 5-10% when it’s something new, fun, or cool? Never.)

It’s also easy to feel the need to be master of a bunch of areas. Or that just because other people are telling you that you’re missing out on a channel, that you should put resources there. The “answer” is that sometimes you should listen. And sometimes you should ignore those folks.

In fact, when I look at a business and see 4 traffic sources that are contributing equally to the business, I don’t view that as a positive. What that says to me is that one of those channels very likely hasn’t been fully-exploited. Instead, someone is trying to do a bunch of things. And thereby not killing it in any one channel.

In my experience, the companies that have achieved real scale have done so with one or two channels driving the vast majority of success. Not 6 channels all equally contributing.

Of course, we don’t want to be exposed if something happens to a traffic source, and there are definitely times you want to be in multiple places to catch the overflow from one channel to another (see my post here where I talk about the effect re: Facebook Video Ads). It is scary to be all-in, but that’s part of what it takes if you want real success. It’s the very rare marketer that can build a business working 4 hours a week (not that Tim Ferris actually meant only working 4 hours); no, you must go all-in to make great things happen.

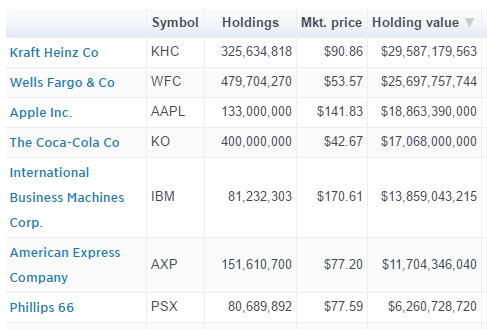

I mentioned Warren Buffet in the title of this post. Let’s look at his investing strategy for a moment. His has not been a big diversification play to achieve his wealth. Sure, Berkshire holds a bunch of different stocks, but did you know that 75% of the value of Berkshire portfolio is held in 7 stocks. Don’t believe me? Check it out

Source: http://www.cnbc.com/berkshire-hathaway-portfolio

Buffet and his team make big picks. And this even with his “Don’t lose money” rule. They don’t do what the public is told – diversify your portfolio, pay that 1% management fee to the mutual funds (which by the way can add up to 30-40% of the value you should’ve had in your bank account), and don’t be too concentrated in where you put your money.

If Buffet and Berkshire were just a one-and-done example, it would be easy to point fingers and say they were asking for it. But nope, their financial performance is well-documented. They are concentrated with the bulk of their portfolio’s holding, and they have managed their risk. They do their homework, have their rules for investing, and when they find something that matches their criteria, they go all-in.

The reality is that there are HUGE societal pressures not to go all-in in pretty much anything we do. Most entrepreneurs don’t succumb to the traditional risk issues associated with starting a business, but that doesn’t mean that same pressure doesn’t affect how you manage your businesses. It seems logical to be diversified in how you run a business, doesn’t it? Diversification is what we are told repeatedly.

But when you actually look at successful companies, you’ll find many more instances of concentration and focus, as opposed to diversification.

With all that, then what do you need to scale a business?

Two offers. Two channels.

That’s it.

Two offers. Two channels.

(Of course, there are numerous aspects to scaling – I’ll touch on those in my subsequent posts.)

Don’t just take my word for it. Look at the businesses you want to emulate. Those who you wish you were like.

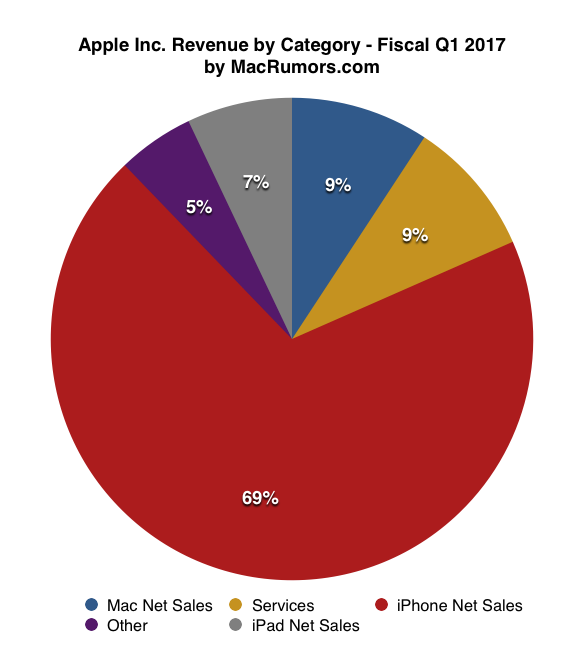

Apple – 60%-70% of its sales come from the iPhone

I’d argue their channels are their retail locations and then carrier partnerships. They don’t really dominate in a direct-to-consumer, e-commerce model.

Guthy-Renker – Proactiv was a billion dollar brand for them. And as much as they were in kiosks and on radio, TV was their primary channel.

AOL – you might not remember it, but the ISP grew because of those CD’s they mailed to everyone.

BioTrust – they have focused on supplements and grew heavily on the backs of affiliates and their excellence with email.

The list goes on and on.

When you find success, go hard after it. Don’t look at your other channels and offers and feel bad that they aren’t performing. Instead, lean in to success. That leaning in might help you to fund those areas that aren’t as successful. But remember this, when you are really exploiting an opportunity, that’s at the “expense” of something else. You need to give disproportionate attention to certain parts of your business. Outsiders will tell you that you’re missing out on other opportunities. So long as you’re scaling something that’s working, then take that criticism as a good thing, as a sign of putting your head down to focus on something that has legs.

Business can be personal. But your offers and channels are not your children. They aren’t your students. They aren’t your patients. Their feelings are not going to get hurt when you ignore them.

As silly as it sounds to make those comparisons, it’s very easy that just as we endeavor to treat those around us fairly and equally, that same mindset can be damaging to your business.

Getting focused on and in your business doesn’t only mean giving it its due time, effort and mindshare. Being focused means that time, dollars and resources are put into the highest-leverage, scalable opportunities.

Just as your friends may criticize you for not “having balance” in your life, or for not doing the same things you used to do (read: the things they want to do), you’re going to face those same types of comments when it comes to your business.

We all must get over it.

And need to go find those two offers and two channels.

Remember, concentration and focus, NOT diversification, are core aspects of the success you’re wanting to create.

(Join my newsletter here to get notified of Parts 2 and 3 of this series.)

Leave a Reply

You must be logged in to post a comment.