This is not a “how to start a subscription business from scratch” piece. If you want to know the first 3 things you should do, stop here. That’s not what you’re going to find.

This piece is intended for marketers with at least $5 million of annualized revenues, and certainly those into 9 figures. There are plenty of resources on getting started. My expertise is in optimization and scale. In bringing together analytics to drive actionable marketing insights for subscription businesses, whether a subscription box business, SAAS service, or another type of recurring revenue model.

Feel free to call this a process or a framework, but at its core, it’s about taking apart the business to ensure that the key components and levers are understood. And then in putting resources in areas that will provide the biggest bang for the buck.

The fact that the list below looks like a step-by-step process is a bit misleading because you don’t wait until one stage is done to move on to the next. Similarly, if you move on to the next, it doesn’t mean that the prior stage is “done.”

I’ll provide a bit of rationale for the sequencing, and then specific and deeper insights into each.

Here’s the sequence I use when helping those with subscriptions and recurring revenues:

- Retention

- Build Customer LTV Model

- Evaluate media

- Funnel reporting and testing

- The value of being a member / customer journey mapping

- Social / Content

- Operational improvements

If you’re in the TL:DR camp, here’s a brief summary of the steps with a much more extensive write-up on each.

The first thing to make sure is well-understood (regardless of how optimized or not it is) is the value and lifetime of a customer. What’s the average stick rate and cancel rate of a customer and how does that vary by traffic source, partner, plan/SKU, etc?

Armed with that info, building the customer LTV/unit economics model is a natural next step. The first step helps to understand how long customers stay around, the second step is about rolling in day 0 revenues and the cost structure to get to a gross margin value per customer. As I mentioned earlier, getting to step 2 hopefully clearly doesn’t mean that the work on retention is done. Understanding churn, why people cancel, particular drop-off points in the lifecycle, as well as a sensibility around the various touchpoints that can affect retention, means the beginning of a bunch of work in improving the business. More below on this point.

Once the value of a customer is known, whether in aggregate or by traffic source, it makes sense to (re)-evaluate paid media. Hopefully, there was a reasonable sense of the value of a customer and target CPA prior to this process, but undoubtedly this framework helps to improve model assumptions as well as inspiring a revisit of how paid media has been managed. Note that I’m grouping together all media – whether Facebook, Google, or TV on the true paid side, as well as any affiliate and influencer campaigns you may have running.

From there it’s about funnel reporting and a testing plan. What happens when customers hit your site – what percent of them convert, what’s the average order value, what happens to those who don’t convert? These are only a few of the necessary metrics to understand and then to test to improve.

At this point, I’ve found that it makes sense to build a customer journey map. Whether in a simple file like this one, or as a beautiful graphic, the point is to make sure you and your team keep in mind the state (mental and emotional) your customer is in, and then how your goals compare to those of your customer.

I’m the first to say that this type of work hasn’t come naturally to me, but it’s not simply a feel-good exercise. It should absolutely drive action. If it doesn’t then scrap it.

From there, dig into the email campaigns, which arguably should have a significant impact on your company’s bottom line. Remember that many customers who come from paid traffic don’t convert right away – they need to learn more about the business, the brand and otherwise. Email is a crucial part of keeping them warms, sending offers, etc. It’s also typically where a lot of the conversions that happen on a last click basis end up being driven.

I have a feeling that some folks may think this next section should come first, not #7 on the list. If you’re a startup, then social and content may be one of the first things you focus on. I put organic social and content here because they are important, but for most companies with some semblance of scale, not to the extent the prior areas are. They might’ve gotten you to this place, but as the business has grown, those prior steps becoming increasingly important to get dialed in. That being said, I know folks who drive a ton of traffic because of the content they create. Or others with massive engagement on their social platforms. Putting attention on owned and earned media is a big deal. As is building a community around your brand. That’s a bit of what these two can do.

Finally, concurrent with this framework is work that happens on the more operational side of the business. Working to improve the product and making operational improvements (warehouse, customer support, etc.) can and should be happening on a regular basis.

Now, Digging Deeper

- Retention, Cancels, Churn, & Lifetime Revenues

Regardless of the category in which you play, if you’re in the subscription business, these are some of the most important metrics to understand.

I like breaking down retention by cohorts – essentially grouping customers – by their join month at the simplest level, and then ideally by traffic source, the offer or plan they took, and any other ways you might group customers. Within traffic source, you can of course break things down to varying levels of granularity; I would just be careful about the volume of data you have to make sure that any analysis you or someone on your team does is statistically significant. Meaning, you might break down Facebook into not just Ad Sets but specific ads within those Ad Sets, or you might look at specific affiliate traffic. But if you only have 20 new customers from those more granular views, then the difference of 2-3 customers can have a meaningful impact on your percentage calcs and as such, shouldn’t be trusted.

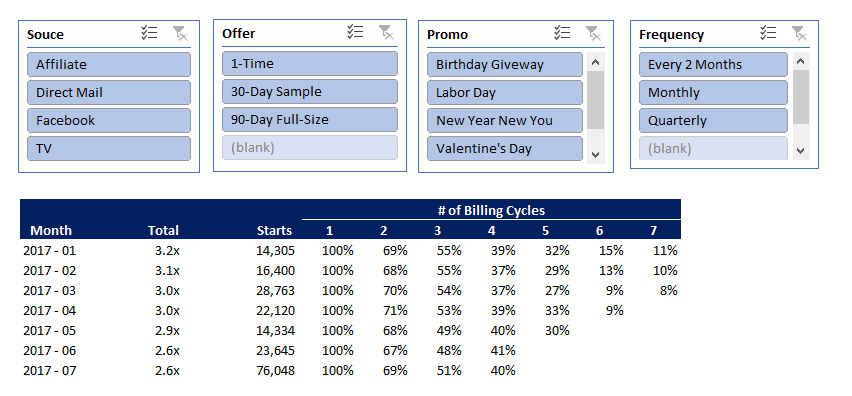

Here’s are 2 views I’ve created for a client:

For a business where the vast majority of customers are on the same frequency of renewing their subscription – whether a Netflix subscription where the concept of pausing is very much the exception or Proactiv which similarly has the majority of customers on “regular” shipment frequencies – this view is the one to start with. I’ll provide the contrast just below.

The core here is to group customers by join month and then to look at the percent of customers who remain at each billing cycle. The calc can be based on the percent of customers billed and/or the percent of customers who haven’t cancelled. There’s nuance to each. That’s why this view is more relevant for businesses where customers are on a regular cadence. If you’re a Netflix customer and you don’t pay, then you lose access to the service, so the those who have been billed and those who haven’t cancelled (or been cancelled) is pretty much the same thing.

An important note, yours might be a quarterly billing cycle, so cycle 2 may mean 90 days out from their original purchase, as opposed to the cycle for Netflix would be monthly. I just want to make sure it’s clear that Cycle doesn’t always equal Monthly.

We’ll talk in a moment about interpreting these tables, but I want to make sure the basics of what’s here are clear. The filters at the top might allow you to segment customers by traffic source (FB vs. Google, or TV vs. direct mail, etc.), by initial offer (a 30-day sample vs. a 90-day sample), or campaign (this might be a promo code or special offer). I’ve just picked a few here. You might include sales rep to the extent that’s relevant, the type of lead they are, or the tier of plan a customer chooses.

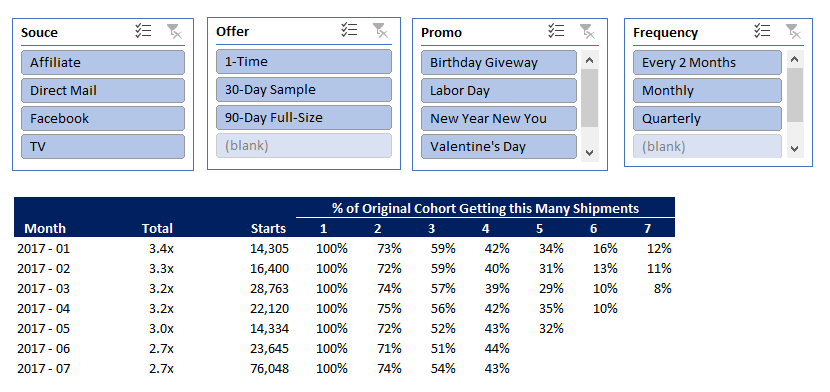

This next view is a shipment-based one.

Since many subscription box companies allow you to pause your next shipment, looking at the percent of customers who haven’t cancelled may not give you a sense of the real value you’re getting. If you’re a Blue Apron customer and you’ve paused your account, you aren’t cancelled, but you also aren’t active. I know this sounds detailed and subtle, but trust me when I say these distinctions can affect how you perceive retention and customer value.

As such, this view is based on the percent of a cohort that has received shipment x, regardless of whether that was in month x or 3 months after the “normal” time. Clearly, this has an impact on your P&L and on cash, and you have to do some of that reconciliation. But it also does help to normalize the analysis around cohorts.

I’ve included the same filters here – clearly, those would be customized to your business as they were in the first example.

How You Can Use These Tables

For starters, they give you a clearer sense of how long customers stick around – whether x number of billing cycles, months, or shipments. Particularly if you’re out raising money, investors want to know how long the average lifetime is. You and your team need to know these metrics.

One of the biggest reasons that reports are important is that they help to reveal differences and changes. How do customers from one cohort compare to another at similar periods? How does the value of a customer differ from one traffic source versus another? Does one sale rep deliver much higher value clients than the rest?

Other questions to consider:

–Do you lose more customers at certain points in the lifecycle? Most trial businesses lose 30% of their customers during the trial period, for example, but might only lose another 15% in the next cycle after the trial. But for some reason it might jump to 25% in the following cycle. This helps to identify where something might be breaking, where customers are no longer engaged, where your team is dropping the ball, etc. Then it’s a matter of putting time and attention towards these issues. To state the potentially obvious, the earlier in their lifecycle the better. It’ll have a trickle effect downstream, but there may be some quick wins you have for slightly more tenured customers that you can affect. I detail some tactics you can use here.

-In that above piece, I speak to making sure you understand the reasons customers are cancelling. For most subscription businesses, these typically fall under:

- Too expensive/don’t see the value

- Don’t use it

- Doesn’t work / Don’t like the quality

- I’m travelling / moving

- Your customer service sucks and can’t help me fix problems

- Delivery issues

Depending on the volume within your buckets, that can help determine prioritization. And help inform ways to address. Delivery issues and customer service are operational issues. If someone cancels because they are travelling, you might add a “pause” feature – or at least tag these customers so that you remarket to them after 30 or 60 days. The top 3 on that list are common and can be issues around marketing, product, follow-up, messaging, etc. Sometimes your pricing is off, maybe your product just isn’t that good, and then the reality is that customers leave. Ramit Sethi wrote a great piece speaking to this point.

–What does the cancel curve look like? Of those who cancel, when do they do so? Are there a bunch of people cancelling on day 0 – so maybe they’re gaming a trial or promo? Or on the day you send notifications about their next shipment (which is pretty common)? Or on the day or two after the next cycle (which means they may not have wanted it and may even be asking for a refund)?

One of the reasons the cancel curve is important not just to understand but to monitor on an ongoing basis is that it can serve as an early indicator of something that has changed. The retention analyses above are crucial, but they can be lagging indicators and analyses around critical business issues.

Look at the chart below:

Note how the cancels in the first 7 days jump from ~4% from Feb-May to 11% in the month of June? That type of behavior will show up in the retention analysis when you do it at the beginning of July, but a) it’s not uncommon to overlook the most recent month, if only because you just have less time and data; and b) those extra days between when an issue pops up, you identify it, and then figure how to fix them are costly. If you knew you weren’t billing 10% of your customers each month, you’d want to know that as quickly as possible, right? Well, of course cancels mean fewer billings.

In this case, something had changed both with the buyer email sequence, suggesting to customers that they needed to take action when in fact they didn’t (an oversight), and with an in-box insert suggesting the same thing. Both decisions had been intentional, but obviously the impact wasn’t. The email was easy to fix; the insert meant getting more printed and then sent to swap out at the fulfillment centers.

Lifetime Revenues

In a nutshell, the above KPI’s have not included any discussion of revenues explicitly. Sure, revenues are components of retention, cancels, etc. But it’s important to look at these things both in the context of counts as well as revenues.

Certain segments of customers may have similar retention rates but different lifetime revenues. Depending on the offer, plan, tier, etc., those would be more obvious. At the same time, some customers may tack on more to their order, whether with additional recurring offers, features, or even 1-time offers.

Regardless, as obvious as it may sound, sometimes we can get so caught up in the above analysis that is based on counts that you forget to layer in actual revenues. To start, you might find it’s necessary to assume an average order value for all customers, but over time, just as the different filters were put in above, being able to pull in revenues for all customers is just as important.

As we wrap this section, I’ll state the obvious – this was a long and meaty section. But in the world of subscriptions, these are some of the crucial aspects to put attention to. Having someone dedicated to owning this part, and then working with others on the team to execute tests and changes, gives you a greater chance of knowing what’s happening in your business and making meaningful changes to it.

As I mentioned early, moving to the next step doesn’t mean step 1 is done. None of these are ever “done.” Rather, step 2, building the unit economics model, is a natural extension to step 1.

- The Unit Economics Model

I’ve written about the importance of knowing the value of your customer and having a robust unit economics model numerous times. I walk thru the actual model here and go over some additional basics here .

I’ll hit only the key points now:

- There are 2 primary reasons you need to understand customer LTV and your unit economics model:

- To manage your media. If you’re running paid media of any form and don’t know the value of a customer, you’re headed for trouble. You need to know how much you generate from a customer, what your goals are (% margin, breakeven by a certain day, etc.), and then that helps you back into your target CPA.

- To identify the key levers in your model and where to deploy resources for improvement, testing, etc. Knowing your baseline metrics and goals is one thing. Great companies believe that they are never fully-optimized and so have a continual testing program. But everyone is resource-constrained, so knowing where to deploy resources is crucial.

- Someone on the team must be accountable for maximizing customer LTV, and as a result, the target CPA. That doesn’t mean they do so at the exclusion of the brand, nor does it mean they do everything on their own. But someone must “own” customer LTV. You’re not going to get better at the pace you want if you don’t do so.

- Customer LTV is a combination of revenues AND costs. It’s more fun and sexier to focus on the former. But if you reduce the latter, that goes straight to more dollars you can put to customer acquisition. Here’s are a couple of my posts about optimizing revenues and costs.

- G&A, investments, capex, etc. should NOT be a part of your unit economics model. The point of the model is to capture marginal revenues and costs associated with those revenues. You don’t need to hire a new person for each incremental order. Sure, at some point, you do need to make those types of commitments, but that doesn’t mean they should be included in that model.

I cannot overstate how important the unit economics model is to running a performance marketing business. It should be a living, breathing model that is updated once per month at minimum, and it should help to inform key testing and resource allocation decisions.

- Evaluating your media

I felt a little unsure about including this step here, as it should be an ongoing point. But given the emphasis I place on the Unit Economics Model, it warrants a moment of discussion.

Once you have a target CPA in place – whether overall or by channel – make sure to communicate that to whoever is managing those channels, internally or externally. And to the extent the models and target CPA change, make sure your partners stay up to date.

At the same time, whether you’re managing paid traffic internally or externally, and feel like you have decent scale or not, I believe there should always be a sense of ongoing evaluation of how you’re doing and who’s doing it. Performance marketing is one of those areas where there should never be a sense of complacency, or really of being content. Those traits can be a harbinger of reduced performance.

If that sounds stressful, it is meant to be.

Sure, your team and partners should have room to breathe, the time to execute, the resources and support to do their best – whatever that means for your business given the constraints you have. But as with our own lives, it can be easier to accept the status quo for too long.

Don’t.

Challenge your team. Challenge your partners. Have conversations with other marketers. Keep a decent network of partners or possible full-time people. The reality is that great people are hard to find, so having this sense of ongoing recruitment, while seemingly time-intensive, can keep you better connected to what’s going on *outside* of your company and keep you connected to good people and partners when you need them. Because you will need them at some point.

- Funnel reporting and testing

This can sometimes be referred to as Conversion Rate Optimization (“CRO”), but I don’t like that term because it seems to exclude revenue. For simplicity purposes in this section, I’m going to assume that traffic is being directed to a website, as opposed to being directed to another response mechanism like the phone. And so to that end, the goal of the site isn’t simply to maximize conversion rate. It’s to maximize revenue per visitor (again, assuming that your model is transactional on your site – if your site is a lead gen tool whereby sales agents call leads, then you just have to adapt the premise here to your model).

But even maximizing revenue per visitor isn’t correct.

Your goal should be to maximize margin dollars per visitor.

I’ve got a ton in this prior post about 6 revenue-enhancing areas to put attention to.

Funnel optimization is implicit across most of those 6 areas.

But once you have a sense of the retention rate and value of a customer, again, without ignoring those areas, it’s time to put attention to what happens when someone hits your site. Reporting is critical to get a baseline. Then start to focus in on the highest trafficked pages on the site, the key leverage points in the funnel, and work to identify where the gaps and opportunities lie.

I’m embarrassed to say it took me so long to get going with heat-mapping tools like Hotjar or CrazyEgg, but they’ve revealed a ton about consumer behavior and have just exposed areas that might’ve been missed.

For example, with a recent client, it was only by using Hotjar that we caught a blind spot in the checkout flow. A ton of potential customers were clicking on the top nav on the final step of the checkout process. As much as I’m all about giving customers what they want and allowing them to navigate, we were hurting ourselves by essentially “suggesting” they click away. Now, there’s also a question about why people were clicking those buttons when they should’ve been ready to close. We addressed that separately, but in the interim, we changed the top nav to a progression bar – and so instead of giving people their “check out the squirrel” opportunity, we kept them focused on the checkout process and saw a 10% lift in conversion rate.

One disconnect I often see with funnel optimization is a lack of communication between customer support and the retention team with whoever is running front-end tests. Hearing the reasons that people are contacting customer support and why they are cancelling can be really helpful to inform front-end tests. Which is another reason I believe in starting this process from the retention analytics side first. Take what’s already happening, and then beginning your way back upstream.

Another area where I see marketers slip is in thinking the funnel work is done once the customer hits the Buy Button. But what happens on the Thank You Page, the order confirm email and beyond are just as important. As is making sure that there is clear accountability within the organization for these parts of the consumer experience.

Whereas some people think the funnel ends once the customer buys, others think onboarding begins after they buy, when in fact the onboarding process begins once the customer engages with you. To that end, a great site with a ton of free content is UserOnboard. They do an amazing job not just of showing what others are doing (they are primarily focused on SAAS businesses), they mark-up their screenshots and provide commentary to identify what they think is being done well and where there are areas of opportunity.

The point being, yes, put time and attention towards optimizing the “traditional” funnel from ad through to purchase. But also be intentional about the path you want to take people down once they have shifted from lead to customer.

- The Additional Value of a Customer / Member as well as Customer Journey Mapping

After digging in on analytics, retention, and some core components of customer acquisition, I like to take a step back to revisit the customer journey and how customers think of the business. We’ll get more tactical after this with email and social/content. As much as I could argue starting with this, oftentimes getting grounded and into these prior areas is a more natural way to understand and to start optimizing the business. Then taking some time to look at the business in a more holistic approach can be a good thing.

I’m somewhat stealing the term of “Member” from Robbie Kellman Baxter, who wrote a phenomenal book called “The Membership Economy” – I highly recommend checking it out.

Now of course she didn’t invent the word or concept of a “Member”. But she has done a great job of helping people shift thinking about customers to members. Think about it for a moment – isn’t a customer different than a member?

Do your customers think about your business as one they subscribe to, or do they think of themselves as being a member of your business or service?

“I get a subscription box from this company” versus “I’m a member of their program” or “I’m one of their members.”

American Express hasn’t used the “Membership has its privileges” campaign in years, as Robbie points out, but you still have the word “Member” on your card, regardless of what color that card is. They’ve done a phenomenal job not just of building a loyalty/point program, but in giving their members real value.

Most recently, they partnered with Shoprunner to give all their (AmEx’s) members free 2-day shipping from a variety of online retailers. AmEx knew it couldn’t do this on their own, and this is one of the big reasons people order from Amazon, but this is a huge tangible benefit of paying for that annual fee, which is still called a “membership fee.”

Ultimately, a member expects a certain type of treatment, expects that you’re taking care of them, giving them value above and beyond what they might’ve signed up for. Whether you’re a subscription box company or a software provider, what are the ways you can add value and make life easier and better for your customers? Some of this might take the form of enhancements to the actual product, or it certainly could extend beyond.

Before jumping in to these additional areas, I’d be remiss to not state what I think might be obvious – there are a bunch of things that should be “check-the-box” items, which you just have to nail.

- Are customers clear about what they are getting?

- Do they get the necessary information about what they’ve ordered quickly (order and ship confirm emails, for example)

- Does the product or service match what they were promised?

- If it’s a physical item, does it show up when they expect to and without delivery problems?

- Can they easily find information about their account?

- When they reach out to customer support, do they hear back in a timely manner?

These are the basics, but anyone who has had issues with the above can attest how hard it is to run your business when the basics aren’t being nailed. So make sure those are being nailed.

I’d also say that the bar continues to be raised about what people expect. As much as I’ve detailed some additional areas below in which to add value to your customers, increasingly, these are being included in your customers’ “check-the-box” category, even though you might not think of it that way.

Here are some areas and examples which you might utilize to build out your membership program.

Offers

- Value-added services (0% margin offers for example)

- Member versions of promos – perhaps in the form of a bonus, an opportunity to get the bonus for a referral, or otherwise

- Special offers

- Buy credits at a discount

Outside Offers

- Gifts/benefits that aren’t explicitly tied to the business’ products

Rewards

- Loyalty / rewards program – including rewards for longevity and continuous longevity

- Acknowledgment / member recognition

- Physical card

- What are the benefits of a higher-tier status (silver, gold, platinum) – pricing, shipping, concierge service

- Unexpected surprises

Connection

- Connect offline / in-person

- Community

- Give them opportunities to participate

- Access – to FB lives, groups, offers, etc

Something else I’ve found helpful – and I’ll admit that this felt too “traditional marketing” when I first started doing it – has been to map the customer journey.

You can see an example of what I mean here – this isn’t a beautiful graphic but it does serve the purpose of illustrating the more traditional steps customer go through (unaware, aware, consideration, purchase), but I’ve also added in a few sections:

- For a subscription box business, what are the sub-steps for an Active customer?

- Where does the interaction take place?

- What are the company goals at each step?

- What are the customer’s goals at each step?

- What is the customer’s mental and emotional state at each step?

For example, once an order is placed, it’s normal practice to send an order confirm email. As the marketer, in addition to making sure the customer gets the necessary confirmation, we might want to give them account details, info about our content, give them additional offers, etc. But generally speaking, the customer wants to know the order went thru and to move on. That doesn’t mean that some of them aren’t open to buying more, reading your content, etc., but I think it’s helpful to keep in mind that the customer is very likely busy, might be excited or might even be experiencing buyer’s remorse. And so, understanding that can help to bridge where they are with our goals.

Everything for me is about driving action. It might seem that this is an exercise that is just “nice to do,” but it should in fact lead to action, lead to changes in how, what and where you communicate with your customers.

And especially if you want to start moving from having customer to members, it’s critical to be mindful about where they are, not just in their customer journey but in their life overall (hint: they are super busy, want stuff done as easily as possible, and want you to be more than 1 step ahead on servicing them even better than you might expect they’d want.)

For some, email feels outdated and unfortunately is ignored. For others, email represents the source of 30% of their revenues.

Email is a big deal and one of the primary means that marketers use to communicate with their customers, separate from their blog, social or in the product itself (whether as a physical insert or through an app or software).

There are a couple components of analyzing what’s happening with email:

- What’s being done to capture emails?

- How effectively are they being marketed to?

In terms of email capture, I’m not a big fan of the pop-up 10% discount offer than shows up on so many sites within seconds of hitting a site. I think it’s a crappy customer experience. That being said, you have to test what works for you.

What I can say is that it’s worth looking at the most trafficked pages on the site to make sure there are at least 2-3 different ways people can opt in – those might include a newsletter sign-up, an optin for a free e-book, and and exit intent pop.

In terms of monetizing the list, most people can get so concerned about unsubscribes that they become too cautious on hitting their list. That doesn’t mean that each email has to be an offer, but certainly even if it’s primarily a content-based email, there should be some link or subtle offer driving them to your site.

The early-engagement series, both for buyers and prospects, is particularly important. Most people are the hottest they’ll be for your brand in the first 7-10 days. So getting in front of them, whether to make sure they get and stay engaged, or to show them the value of your product to get them to purchase, is critical.

I do want to make a small note about the long tail. I work with a client where more than 60% of their revenues come from customers who’ve opted in more than 30 days ago. They have a higher-priced service, so it makes sense that people need time. But this just emphasizes the need to keep (engaged) people on the list, as well as the importance of content and brand. When customers take longer to convert, it’s even more likely that your brand is going to have an impact on their chance of success. So, too, will content – more in a moment on content, but keeping using it to keep your email list engaged can have a big difference on your bottom line.

Finally, remember that solid open rates on emails can be 30%. Just because someone hasn’t opened or clicked on what you thought was a great offer doesn’t mean they aren’t interested. There’s always a component here of playing the numbers.

- Social / Content

Social and content are great ways to increase engagement and connection to your brand. They are also natural ways to provide value-added content to your audience, whether as an acquisition or retention tool.

Content marketing is no longer a buzzword, it’s what people are expecting. And it can be delivered on your site via a blog, thru email, and on social. And with sites like Problogger, Upwork and Craigslist, it is getting cheaper to source great writers and editors to help craft quality content for your business.

Plus, don’t forget about soliciting user-generated content (“UGC”). Sometimes you just need to ask for feedback or a video – whether that helps to inform the product or service, or it can be used as content to market with (make sure you get someone’s okay before doing so), taking advantage of content that is educational, inspirational, and/or entertaining is a big plus.

- Operational Improvements

I’ve intentionally focused on the marketing side of the business in this piece.

A few words on Product and then a couple more with an additional link on Cost Optimizations.

Product – I cannot emphasize how important product is. All the marketing, analytics and optimizations are a ton easier and more effective with a solid product. And just that much harder with a bad one. SAAS businesses seem to have a culture of continual improvement, in the form of releases, but many in the physical products world rarely have that culture as a core part of the business. If you’re in this world, I’d suggest taking a cue from SAAS businesses.

Customers expect that their software or app will constantly be updated. How many updates have you gotten for your smartphone apps in the past couple of days? Likely a bunch. So why don’t physical products have anything close to that cadence? Well, for starters, it’s easier to push an update live for software than to do the analogue in the physical world. And yet that doesn’t mean they aren’t possible. Please put some attention to do so regardless of your business.

Finally, cost optimizations.

If you’ve made it this far, then I’ll simply suggest you check out this link where I detail some of the core cost-related areas to optimize.

In Summary

Phew, there’s a ton here. There’s also a ton to your subscription business. There are a lot of areas to target. But my final suggestion is to make sure to key in on the main leverage points in your business. Everyone is resource-constrained so making sure you and your team are focused on the biggest opportunity is crucial.

Hopefully, working your business is a lot of fun. There are plenty of rough patches and frustrations in any business, but the sheer number of ways you can affect your customer’s experience means there’s never a dull moment and plenty of places to make a difference.

I hope these thoughts help you to improve your business.

And if you have any questions or thoughts, I’d love to hear them.

Leave a Reply

You must be logged in to post a comment.